Invesco Summit Growth Range

We are pleased to announce that the Invesco Summit Growth range is now mapped to FinaMetrica risk tolerance scores.

A truly diversified source of returns

Summit benefits from access to a huge range of different investment capabilities, approaches and perspectives.

While many UK investors are familiar with our Henley investment centre, some are less aware that Invesco has 12 other independent investment centres around the world.

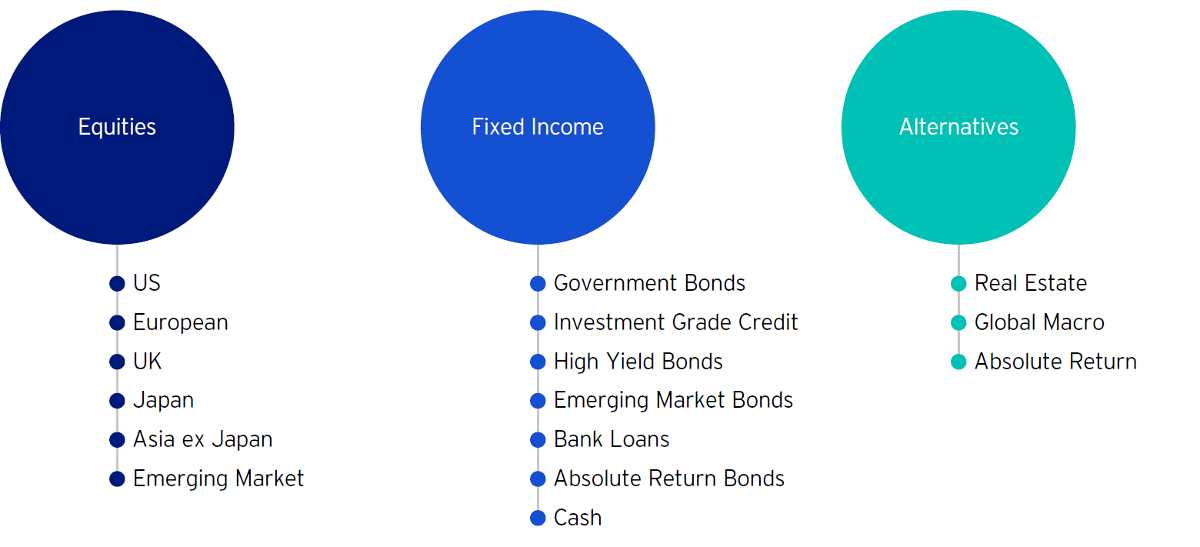

Invesco's capabilities span all major asset classes (both traditional and alternative), across active, factor-based and passive strategies.

While it is important to achieve diversification between asset classes, Invesco aims to also achieve diversity within asset classes. For example, in addition to the more traditional parts of fixed income such as government bonds and credit, it is also able to invest in other opportunities such as senior secured bank loans and emerging market bonds.

Similarly, in the alternatives space it has access to a broad range of capabilities from absolute return strategies to real estate.

This means the ability to choose from more than 500 funds and 300 ETFs in-house, to build portfolios with truly diversified sources of returns.

A different approach to risk

Invesco’s approach to risk is different too. Risk is complex and multi-dimensional so it thinks about risk in a number of different ways, from the potential for capital loss to volatility.

When thinking about volatility, Invesco think about it in relative rather than absolute terms, and express targets as a proportion of global equity market volatility.

That's because market volatility is often at its lowest just before a market crash, and often at its highest during the market's lowest point.

An absolute volatility target could mean that an investor is forced to buy higher-risk assets at the wrong time (during the calm right before a storm), simply to meet a risk target.

A relative volatility target can mitigate this and helps Invesco to remain more closely aligned with its intended risk profiles over the long-term.

The Summit Reporter

Summit is more than a range of funds. It also aims to help reduce the increasing administrative burden faced by advisers.

In addition to a range of due diligence materials and ongoing communications, Invesco have created the Summit Reporter tool to enable you to efficiently inform clients of their investments.

Quick and simple to use, you can select from a variety of asset breakdowns, exposures, and fund manager commentaries to create a bespoke client report, personalised with your own logo and your client's name.

Making your life easier

The Summit range draws on Invesco's key strengths to deliver a robust investment solution that provides peace of mind for you and your clients. To find out more about more about Summit, and how it can help you meet your client's needs, click here.

Important information

This article is for Professional Clients only and is not for consumer use.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

Issued by Invesco Fund Managers Limited Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.

Posted: 23/01/2019 11:19:00 AM by

FinaMetrica Pty Limited